On Tuesday 9 May 2023, Treasurer Jim Chalmers handed down the 2023-24 Australian Federal Budget. The budget is a comprehensive financial plan that outlines the government’s spending priorities and revenue projections for the upcoming fiscal year.

The civil construction industry is a significant part of the infrastructure sector in Australia, and the Federal Budget announcement included several items related to the industry.

Some key items were identified which require further clarification to assess the impact on the industry. These include the retention of the $120 billion 10 year rolling infrastructure investment pipeline. However, the precise pipeline of projects in the short to medium term will not be known until federal, state and territory governments conclude and release the findings of the recently announced 90 day into the $120 investment pipeline.

Treasury officials have agreed to meet with our CCF National office this Friday to provide a debrief on the infrastructure spend contained within the budget papers. They will also review and discuss the results of CCF’s 2023 National Infrastructure Market Capacity Survey, which is currently open for industry input.

We will provide a further update following that meeting as we are updated.

Some key highlights announced in the budget are outlined below.

INFRASTRUCTURE

The Budget included a firm commitment to retain the 10-year, $120 billion pipeline of infrastructure projects, with Infrastructure Minister Catherine King stating that “every dollar remains in the budget”.

In 2023–24, the Australian Government will provide funding of $15.5 billion to support state infrastructure projects (please refer to Appendix 1, page 4 of the CCF budget brief for a detailed breakup of the spend).

As previously advised however, the Federal Government with the support of all State and Territory governments is conducting a 90-day review into the $120 billion investment pipeline confirming the review will enable it to consider the projects that are priorities and assess their cost and deliverability in the current climate. Civil Contractors Federation will be contributing to this review.

TRANSPORT & COMMUNICATION INFRASTRUCTURE

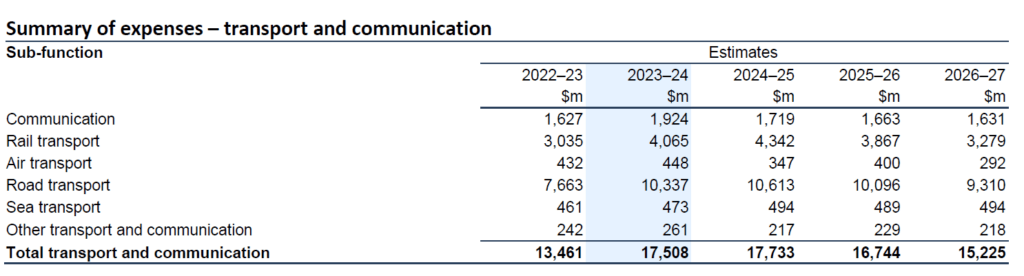

Transport and communication infrastructure includes expenses to support the infrastructure and regulatory framework for Australia’s transport and communication sectors.

Expenses under the communication sub-function relate to communications activities and support for the digital economy through the Department of Infrastructure, Transport, Regional Development, Communications and the Arts, and the Australian Communications and Media Authority. Total expenses under this sub-function are estimated to decrease from 2023–24 to 2026–27 primarily reflecting the profile of funding for communications programs included in the October Budget measure Better Connectivity Plan for Regional and Rural Australia, and the conclusion of the Mobile Black Spot Program and Connecting Northern Australia initiative.

Expenses under the rail transport sub-function primarily consist of grants provided under the Infrastructure Investment Program. Expenses are estimated to increase from 2022–23 to 2023–24, and decrease from 2023–24 to 2026–27. The initial increase and subsequent decrease in expenditure reflects the schedules of major rail infrastructure projects, including the completion of projects under the METRONET program.

Expenses under the air transport sub-function primarily relate to activities of the safety regulator Civil Aviation Safety Authority and aviation related initiatives. Total expenses are estimated to decrease from 2023–24 to 2026–27 due to the conclusion of a number of aviation initiatives, including Enhanced Regional Security Screening, upgrades to Hobart and Newcastle Airports, and the Regional Aviation Access Program.

Expenses under the road transport sub-function primarily consist of grants provided under the Infrastructure Investment Program and are estimated to increase from 2022–23 to 2023–24, and then decrease from 2023–24 to 2026–27. The increase and subsequent decrease in expenditure, reflects the Government’s continued investment in priority road infrastructure projects, including through the October Budget measure Building a Better Future through considered Infrastructure Investment, the realignment of project profiles to more accurately reflect delivery schedules, and the completion of the Bruce Highway and Road Safety Program projects.

Total expenses under the other transport and communication sub-function are estimated to decrease from 2023–24 to 2026–27, reflecting the short-term program support provided through the 2023–24 Budget measure Supporting Transport Priorities.

In terms of new initiatives, the Government has announced two new programs; The Thriving Suburbs Program ($200 million) and the Urban Precincts and Partnerships Program ($150 million) to fund local community infrastructure projects.

The Budget papers confirm that $1.1 billion will be spent over four years from 2023-24 (and up to $3.4 billion over 10 years) to develop infrastructure for the 2032 Olympic and Paralympic Games in Brisbane as well as the previously announced commitments to the Macquarie Point upgrade in Hobart.

The Government has committed to maintaining the $110 million-per-year Black Spot Program to improve road safety across the nation.

An additional $200 million has been committed to the Major Projects Business Case Fund, which pays for early planning of land transport infrastructure projects. This is to help ensure projects are in line with the Government’s policy objectives.

INDUSTRIAL RELATIONS

The budget includes a commitment of $300,000 to fund an external review of the Fair Work Ombudsman’s operations over the next financial year that will influence where the watchdog directs its resources.

It also includes a commitment of $4.4 million to establish the National Construction Industry Forum, which will provide the Government with advice on key challenges facing the building and construction industry, including workplace safety, culture, skills, productivity and gender equality.

TRAINING & SKILLS

The Budget confirms $3.7 billion for the 5-year National Skills Agreement (NSA) between the Commonwealth and the states and territories and also the creation of 300,000 fee-free TAFE places in critical and emerging sectors. Gender equality and women’s participation in labour markets will be a focus of the NSA.

$8.6 million has been allocated to deliver the Australian Skills Guarantee and introduce national targets for apprentices, trainees and paid cadets working on Australian Government funded major infrastructure and ICT projects.

An additional $10 million has been committed to address the risks from silicosis, including expanding the functions of the Asbestos Safety and Eradication Agency to include silicosis and silica-related diseases.

RENEWABLE ENERGY

A new $2 billion fund for the ‘Hydrogen Headstart’ program to scale up development of Australia’s renewable hydrogen industry. The funding will support large-scale renewable hydrogen projects.

Allocation of $1.4 billion through the ‘Powering the Regions Fund’ to support industrial decarbonisation and develop new clean energy industries in the regions, through three new streams of grants.

HOUSING

An additional $2 billion (5.5 billion to 7.5 billion) for more social and affordable rental housing by increasing the guaranteed liabilities of the National Housing Finance and Investment Corporation (NHFIC).

SMALL BUSINESS

Establishment of the Energy Bill Relief Fund to provide up to $3 billion in electricity bill relief to eligible small businesses and households.

Temporarily increasing the instant asset write-off asset threshold to $20,000 for businesses with a turnover of up to $10 million, for one year.

Introducing the Small Business Energy Incentive, a tax deduction to help up to 3.8 million small- and medium-sized businesses save energy, upgrade their facilities and save on their energy bills.

For further information, please read the CCF National Budget Media Release here.

The CCF 2023 – 2024 Federal Budget Brief outlining the infrastructure measures in the budget papers including those listed in above is available here.

The official Federal Budget documents are available here.

If you have any questions in regards to how the new budget measures may affect you or your business, please call the CCF Victoria office on (03) 9588 7600 or email our team at ccfvic@ccfvic.com.au.